The Bank of England has announced the biggest interest rate rise in more than 25 years, putting yet more pressure on Brits already struggling with rising living costs.

The BofE’s base rate – the amount they charge commercial banks for loans – will rise from 1.25 to 1.75 percent, it confirmed this week.

The change in rates will have a knock-on effect on mortgage rates for millions of homeowners and first-time buyers; in fact, Rightmove predicts monthly mortgage repayments will rise from £813 to £1,030 for new first-time buyers – an increase of £200 a month.

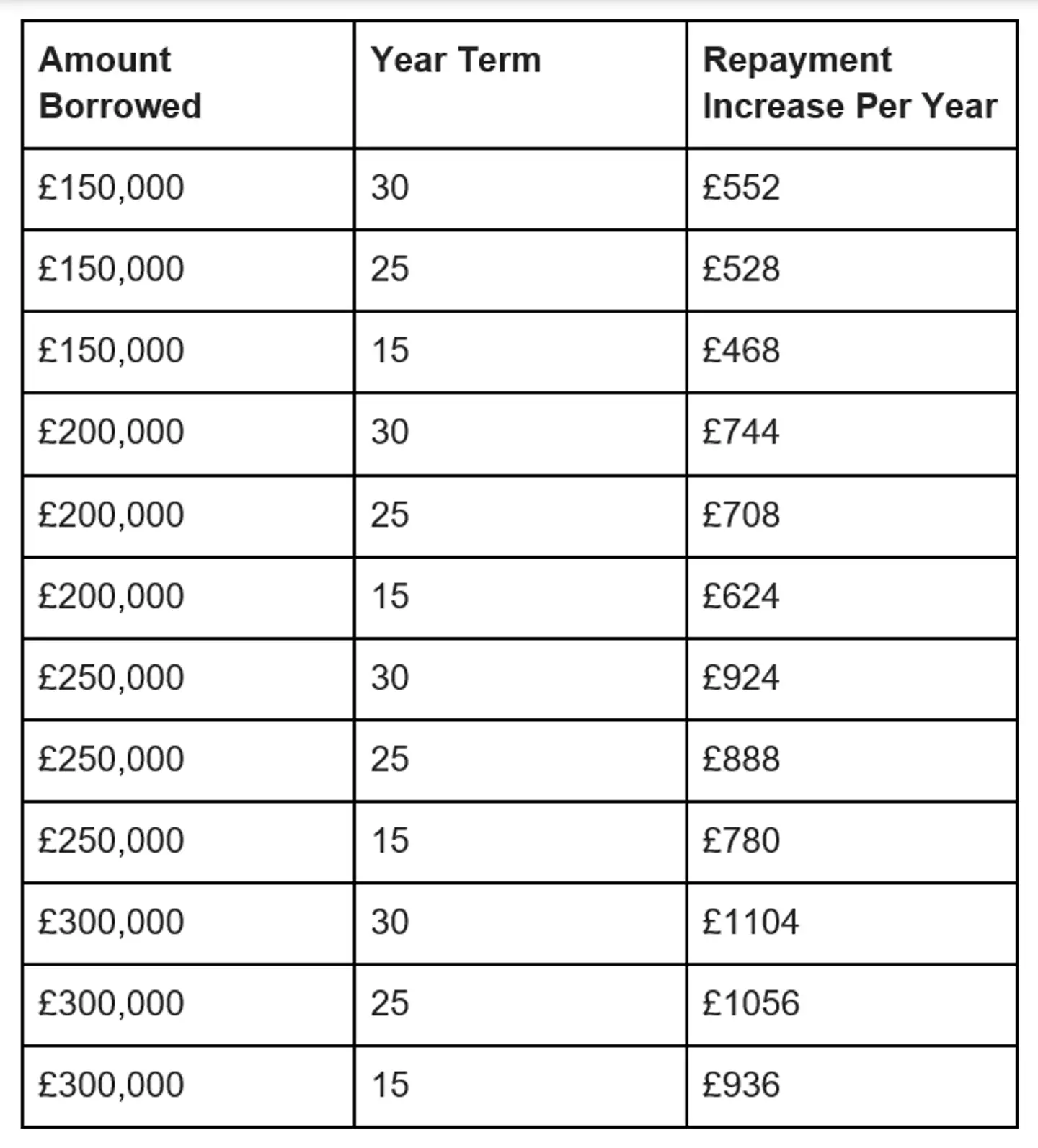

So how much more will you be paying back? An example of the change in rates, based on the current average standard variable rate (SVR) of 5.06 percent, is as follows:

Advert

Homeowners can also calculate their mortgage repayments increase by using online tools such as Money Saving Expert’s repayment calculator.

With the cost of living crisis already bearing down on Brits – inflation recently hit a 40-year high of 9.4 percent – today’s news is set to put even more strain on struggling families.

Rightmove predicts first-time buyers will spend an average of 40 percent of their salary on mortgage repayments under the new rates.

Paul Coss of Haysto, a UK mortgage broker for people with poor or complex credit situations, told Tyla: "A lot of people are expecting a further increase to the Bank of England's base rate [after today], so it could even hit 2 percent by the end of the year.

“Should this happen, we'll start to see a lot of people looking to remortgage, especially if they're on a variable rate.”

When considering what to do in this situation, Coss advises: “It can be a good idea to secure a fixed deal to avoid any further increases. An increase in demand for remortgages – coupled with an incredibly buoyant housing market at present – has already led to a massive surge of mortgage applications.

“We're seeing lots of lenders taking longer to turn around applications because of the volume. Another jump in the BOE base rate would see even higher demand and longer delays.”

Homeowner Tammy, 40, tells Tyla she is no longer selling her home because a new mortgage with increased rates wouldn’t be beneficial to her financially; she has instead chosen to 'stay put until the market looks better' and entered another fixed rate deal to secure a flat rate and will continue to live in her home.

Another homeowner who is on a fixed rate variable that is soon to end, Kirsty, 34, admits that 'the current circumstances are quite scary'. “My mortgage payment will be going up substantially next year which is quite worrying with everything else that's going on,” she says.

Kirsty has made a plan to tackle the rising cost of her mortgage by cancelling contracts on mobile phones and other monthly subscriptions to 'accommodate the increase'.

Paul Coss suggests making changes to lower overall expenditure to make room for these extra costs, such as switching to energy-efficient appliances where possible, and also monitoring your water usage to try to decrease those bills.

Types of mortgages explained

Variable rate

A variable rate is a mortgage that is not capped at a set repayment plan like Fixed Rate agreements and can increase or decrease depending on the Standard Variable Rate which will adapt to align with the BoE rate.

Tracker

A Tracker mortgage is a loan where the interest you pay is set on an external rate – usually the Bank of England’s base rate – so can go up or down throughout your loan depending on market conditions.

Fixed rate

A fixed rate mortgage will see your interest rate locked in for the entire term of your agreed loan, regardless of market changes. Those on a fixed rate will not be affected by the Bank of England’s new base rate.